BALANCED FEDERAL BUDGET – POLICY

1st Core belief: Return as Many Federal Functions to States as Possible

Thomas Jefferson is credited with the quote, “every generation needs a revolution”. We say that now is the time, before it’s too late, we must take power away from congress and give it back to the states; to give the power back to the people instead of special interest groups.

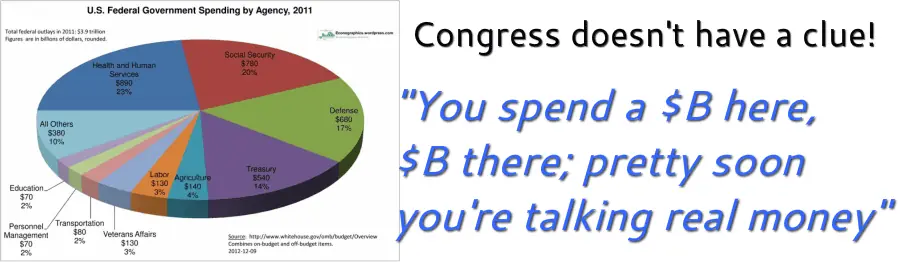

We believe congress and the federal government have done such a dismal job of being responsible with the taxpayers money that they should be responsible for ONLY those tasks clearly specified in the Constitution and that cannot be performed by the states, such as:

- National Defense & foreign policy

- Border control & immigration

- Old age insurance (better known as social security)

- Transportation

- Space & Technology

The US Federal Budget should be re-appropriated according to the following rationale:

- It doesn’t make any sense for the federal government to borrow money (from China!), just to turn around and give some of that money to the states.

- The federal government shouldn’t tax its citizens within states just to turn around and give some of the money back to the states. For if they do, they will tell the states what to do in completely unrelated items.

- It is extremely clear that the federal government (Republicans and Democrats) has no control of its spending and should have as many governmental functions / budget items and programs transferred to the states as possible.

- The federal government should only be in charge of federal functions strictly outlined in the US Constitution plus social security.

- States utilize a more just & more efficient means of generating revenue via the use of sales taxes and/or income taxes.

- The states should be placed totally in charge of taking care of their citizens and not the federal government. Any federal government functions that deal with health, housing, education, food, or social welfare should be transferred to the states.

- Since states must balance their budgets, they would be more fiscally responsible with social programs and education.

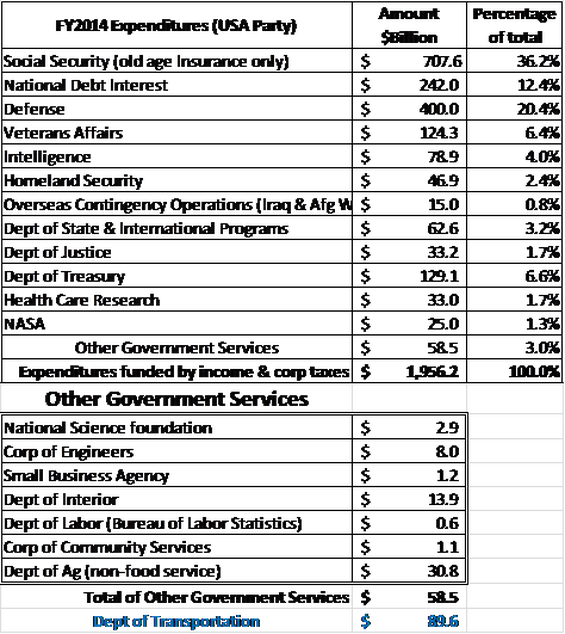

The USA Party BALANCED Budget Proposal for FY2014

The best thing about this BALANCED BUDGET PROPOSAL is that no government programs are cut by Congress; we only shift these government functions to the states for 3 years and reimburse the states with Block Grants. After 3 years, the states would be totally responsible for those functions should they choose to continue them.

programs are cut by Congress; we only shift these government functions to the states for 3 years and reimburse the states with Block Grants. After 3 years, the states would be totally responsible for those functions should they choose to continue them.

Some Assumptions:

Starting with the FY2014 Whitehouse proposed federal budget of $3,727B, we have reduced the federal budget to $1,956.2B. Please note the budget is balanced after 3 years. In order to get to this number, we made the following assumptions:

- We have reduced DOD base spending from $530B to $400B, which is still much greater than the $287B before 911.

- We have reduced the Overseas Contingency Ops from $126.3B to $15B since the wars should be winding down considerably for the next few years.

- Only NASA was increased from $19B to $25B, IF they commit to the proposal in Core Belief #11.

- Only the Bureau of Labor Statistics would be retained by Dept. of Labor. Dept. of Transportation $89.6B is totally removed from the general budget; and funded independently via fuel and airline ticket taxes.

- We have moved $1,262.4B to the states, which will be funded by Block Grants for the first 3 years

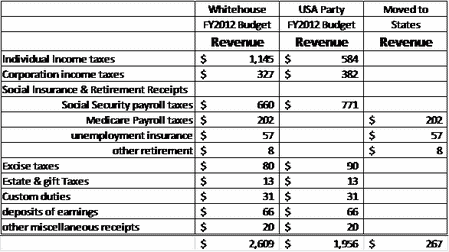

See the table below for revenue projection comparisons and Core Belief #3 for our philosophy on who pays income taxes. We obtain 16.8% more revenue from the wealthy by setting the maximum tax rate at 25% with the stipulations of: All income is treated equal and no deductions are permitted. However, since the middleclass pay no tax, our tax revenue is only 51% of current FY 2012 forecast ($584B vs $1,145B).

- We obtain 16.8% more revenue from businesses by 25% flat tax on profit from all organizations (and their subsidiaries) doing business in the USA.

- We obtain 16.8% more revenue for social security by removing caps.

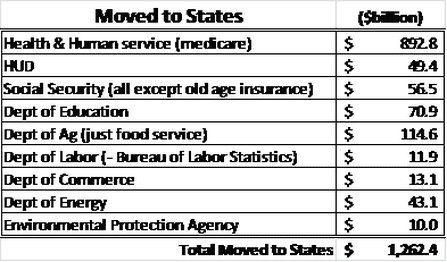

Expenditures Transferred to the States

We propose that the following Federal Government expenditures should be moved to the states as shown in the chart to the below. The tax revenue (or borrowing) that the federal government obtains for the $1,262.4 Billion in federal functions would be transferred to the states. We also show that $267 Billion in Federal Revenue will be moved to the States as all functions for the health, education, employment, and welfare of individuals are moved to the states. The excise tax on gasoline, diesel, and jet fuel has been increased to match the expenditures by the Dept. of Transportation. We go into great details in Core Belief #7 on the Dept. of Transportation.

SUMMARY

As you can see from the charts below, we propose that $1,262.4 Billion (over $1.2Trillion) in annual Federal expenditures can be shifted to the states, but only $267 Billion in added income. By transfering $1.2Trillion to the states and cuts to Defense Spending, the new expenditures is only $1,956.2 Billion (as shown in the above chart); the Federal Budget hasn’t been that low since 2001. This amount of expenditures matches the projected Federal Revenue shown in the table below – right; Thus, a Balanced US Federal Budget!